Blockchain Technology in Banking and Finance - Business

Commercial Banks provide a number of services to their consumers. By creating an account, users can pay bills with a slip of document. In addition, the user can send and receive money from various bank accounts. Today, more users are using mobile internet for banking service, to pay their bills. In addition, Banks providing credit cards and debit cards in the field of shopping to spend without physical money in stores, gas services, and other stores. Nowadays, the banking Industry is offering Modern Services to customers in the financial system to attract more customers. Therefore, at this point of view while entering into the advanced technology implementation in the banking system, many problems created by hackers and spammers, where hacking the accounts and misusing the Banking system.

The banking application stringently controlled in all rights, while banking sector agents identified by their conventional methods. But the wide distribution of Blockchain in the modern years, the strong popularity of cryptocurrency growth have provided with the evidence that the control of many banks and financial companies are strongly committed to implementing Blockchain technology. This made a huge demand for Blockchain Development Companies in India. In addition, presented their uniqueness to Banking Industry hold the opportunity for developing an application integrated with Blockchain technology.

The Blockchain is the Remedy for Banking Services

Banks and Financial Companies can control a number of challenges with the help of Blockchain development. It has various smart features that perform it as engaging as Linux. Blockchain technology presents a high-level security in collecting and sending data, transparency, simple interface support, decentralization and low cost of operations. These impressive characteristics make Blockchain a really capable and in-demand result, even in the exceedingly traditional and controlled bank industry.

Most securities and financial systems cannot provide out their Blockchain without a character of mediators, while their support secures the services of these companies much more secure and expensive. The implementation of Blockchain will allow Banking to remove additional mediators and to present secure payment services for customers.

How Blockchain performs in Financial System?

The Blockchain technology is a shared, decentralized ledger that allows Bitcoin, Litecoin, Dogecoin, and other digital currencies to accessible, secret, and protected. The Blockchain is a database of digital money transactions called Bitcoin. Moreover, it also called as a Public ledger, to maintain the records of shared transactions, that contains metadata about the history of transactions taken place. The record is publicly available through APIs and current sites. Blockchain controls a permanent record of activities. This significantly decreases the chance and the necessary for associated mitigating actions for various asset models.

Popular Blogs

-

- How Secure Is Blockchain Technology Jul 7, 2021

-

- Zero investment business in India Jun 25, 2021

-

- How Will Blockchain Technology Change The World Apr 19, 2021

-

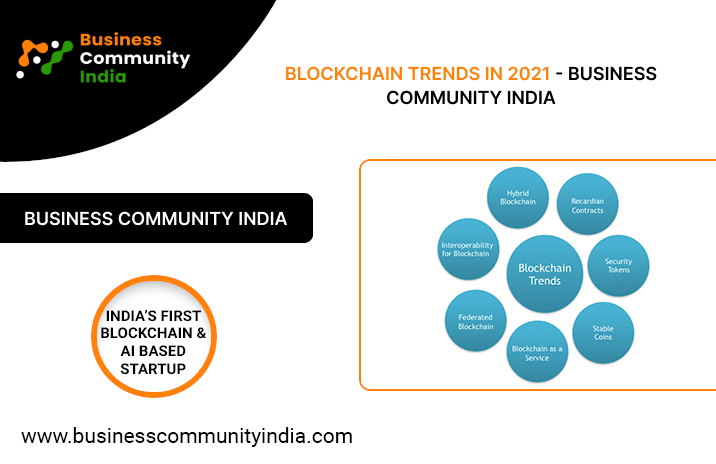

- Blockchain Trends in 2021 - Business Community India Feb 12, 2021

-

- Business Community India The Growth Partnership Feb 4, 2021

-

- Partnership With Business Community India Nov 30, 2020